how much tax do you pay for uber eats

If you have more than 400 in income from your ridesharing work you need to pay self-employment taxes. In relation to providing.

How To Make 1000 A Week With Uber Eats Gridwise

Use business income to figure out your self.

. Recently Ubers UK head of public policy Andrew Byrne revealed three typical hourly rates. Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach. All you need is the following information.

In New Zealand you may need to register for GST if your turnover exceeds or is expected to exceed 60000 in a 12 month period. Do you have to pay tax on Uber eats earnings. If you drive for Uber and Uber Eats you will need to be registered for GST and pay GST on both your rides with Uber and food delivieries.

Using our Uber driver tax calculator is easy. Driving for Uber and Uber Eats. Your average number of rides per hour.

Delivery driver tax obligations. You will receive one tax summary for all activity with Uber Eats and Uber. If your accounts for Uber Eats and Uber use a different email address your earnings from deliveries and rides will.

The amount youll pay depends on the amount and types of other income you have your filing status the tax deductions and credits. How much should I set aside for taxes with Uber Eats. How much should I set aside for taxes with Uber Eats.

Then you subtract the expenses from the income. Regardless of how much you make according to the ATO any income you earn as a food delivery driver must be declared on your tax return. The amount of tax you will pay on your Uber profits depends on your total taxable income which includes income from other jobs and other sources.

To avoid the estimated tax penalty you must pay one of the above. The money left over is the basis for your taxes. 110 of prior year taxes.

Your federal tax rate can vary from 10 to 37 while your state rate can be anywhere from 0 to 1075. My question is do i need. Your federal and state income taxes.

For more information on how much tax youll pay check out or blog post on How Much Youll Actually Make Driving For Uber. IRD and GST registration. The average number of hours you drive per week.

The city and state. The exact percentage youll pay. Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach.

AGI over 150000 75000 if married filing separate 100 of current year taxes. 9 per hour if youre paying for your car through car finance. Lets make it easy with an example the submission of the.

For the majority of you the answer is yes If your net earnings from Uber exceed 400 you must report that income. Uber drivers are required to submit their tax returns by 31st January if submitting online and by 31st October if submitting via post. Do you have to pay tax on Uber eats earnings.

For the 2021 tax year the self-employment tax rate is 153 of the first. As you can see how much you can make with Uber Eats depends on a variety of factors with one of. 950 per hour if you drive your own car.

You should file a Form 1040 and attach Schedule C and Schedule SE to. Uzair July 24. Estimate your business income your taxable profits.

What the tax impact calculator is going to do is follow these six steps. If you have questions on whether you need to register for GST due to how you partner with Uber we would recommend you contact the ATO or a taxation professional directly for advice. The current surcharge is scheduled to remain in place for the next 60 days.

It is not necessary for those who do. The amount youll pay depends on the amount and types of other income you have your filing status the tax deductions and credits. If you had 20000 in earnings and 10000 in expenses your profit is 10000.

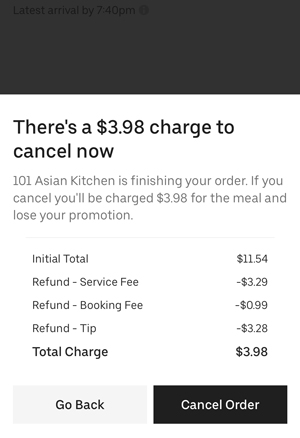

Uber Eats Adds 3 Portland Customer Fee On Food Delivery Orders After City Approves 10 Commission Cap Oregonlive Com

Uber Eats Overcharges New York Customers On Sales Tax New Class Action Alleges Top Class Actions

400 Of Food 10 In Pay No Tip Working Washington

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Overhauls Its App To Combine Eats And Rides Businesses In One Place

Uber Eats Service Fee Essential Information To Know Ridester Com

How Do Food Delivery Couriers Pay Taxes Get It Back

Filing Taxes As A Bicycle Courier R Ubereats

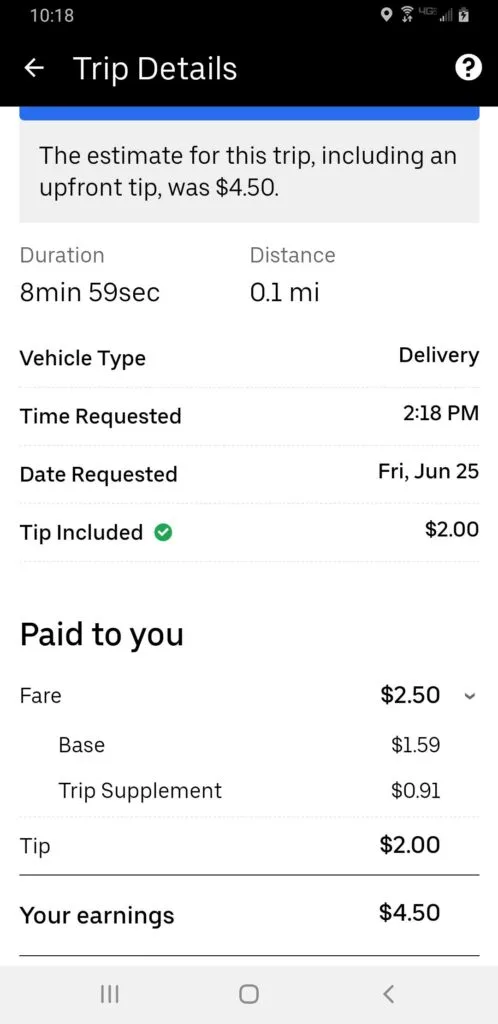

How Much Does Uber Eats Pay Per Delivery In 2022 Ultimate Guide

Uber Eats Riders Earning As Little As 5 For Deliveries Crossing Multiple Nsw Suburbs Uber The Guardian

The New Uber Eats Pay Model 7 Takeaways Entrecourier

Uber Eats Taxes How To File Taxes For Uber Eats And Tax Forms Tfx

How To Pay Cash For Uber Eats If You Re Outside Of The Us

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

How Much Does Uber Eats Pay Your Guide To Driver Pay 2022

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How To Enter Banking Information On Uber Eats Manager Uber Eats Youtube