montana sales tax rate 2019

The jurisdiction breakdown shows the different sales tax rates making up the combined rate. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275There are a total of 307 local tax jurisdictions across the state collecting an average local tax of 2614.

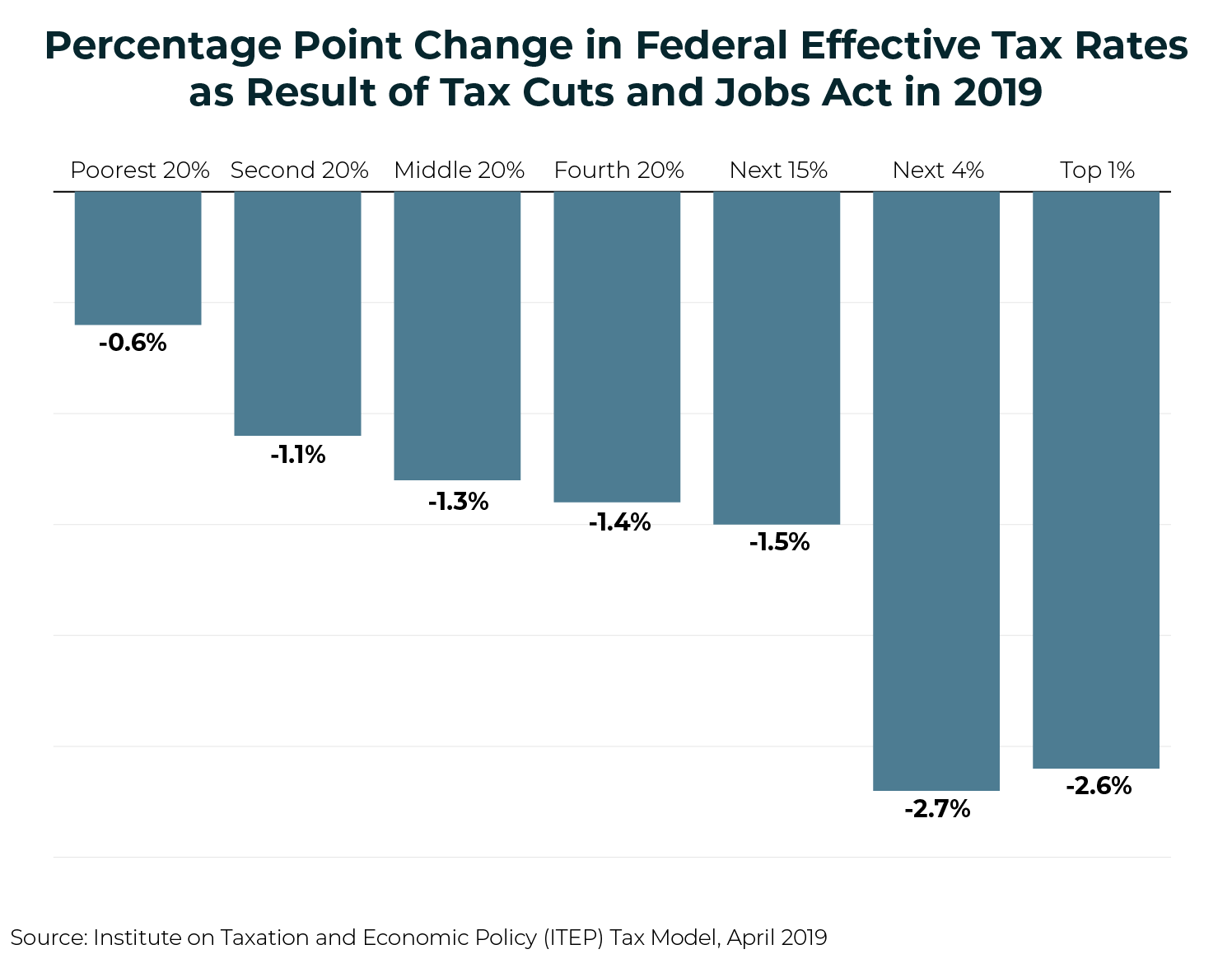

Who Pays Taxes In America In 2019 Itep

Special taxes in Montanas resort areas are not included in our analysis.

. California has the highest state-level sales tax rate at 725 percent. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. Besides an RV sales tax tends to be significantly lower than those who pay in form of VAT such as the Europeans or the Brits.

While most taxable products are subject to the combined sales tax rate some items are taxed differently at state and local levels. No sales tax in Montana. The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted.

Five states do not have statewide. 2019 Yes No 2018 Yes No Reason for Tax Clearance. Purchasers must pay use taxes for all items bought from out-of-state retailers only in states that charge use taxes.

State and Local Sales Tax Rates Midyear 2018. For tax rates in other cities see. The state has no state sales tax but does levy excise taxes including taxes on alcohol and its average property tax rate of 186 of property values is the third highest in the country.

Local sales rates and changes. Illinois IL Sales Tax Rates. The Florida FL state sales tax rate is currently 6.

Tue Jan 01 2019. Tax applicable on camper varies based on State and even county. Idaho ID Sales Tax Rates.

Nebraska NE Sales Tax Rates. The Role of Competition in Setting Sales Tax Rate. Make a tax payment.

There is no applicable city tax. In doing so the. Compare 2022 sales taxes including 2022 state and local sales tax rates.

Use taxes are generally the same tax percentage as a states sales tax rate. Depending on city county and local tax jurisdictions the total rate can be as high as 8. Tax Policy and Statistical Reports.

State and Local Sales Tax Rates 2019. In the state of Florida all sellers of tangible property or goods including leases licenses and rentals are required to register with the state and file and pay sales tax. Address tax rate locator.

Click here for a larger sales tax map or here for a sales tax table. Sales tax rates differ by state. On June 21 2018 the United States Supreme Court ruled in a 5-4 decision in South Dakota vWayfair Inc et al that states can generally require an out-of-state seller to collect and remit sales tax on sales to in-state consumers even if the seller has no physical presence in the consumers state.

This page provides detail of the Federal Tax Tables for 2019 has links to historic Federal Tax Tables which are used within the 2019 Federal Tax Calculator and has supporting links to each set of state. Currently Alaska Delaware Oregon New Hampshire and Montana dont require use taxes to be assessed to purchases from out-of-state retailers. What Happened in South Dakota v.

You can print a 95 sales tax table here. Nevada charges a state sales tax of 65 percent a government services tax of 14 percent and a gas-guzzler tax on cars that get less than 225 miles per gallon. The 95 sales tax rate in Los Angeles consists of 6 California state sales tax 025 Los Angeles County sales tax and 325 Special tax.

You can either collect the sales tax rate at the buyers ship-to address for all orders shipped to Tennessee. Fri Jan 01 2021. Montana MT Sales Tax Rates.

Copy of prior-year tax documents. Have changed since Utah increased the state-collected share of its sales tax from 595 percent to 61 percent in April 2019. Sales of 100000 or more in the state or at least 200 individual sales transactions into the state in the current or last calendar year.

For example while New Hampshire has no state sales tax the fees you pay to your local town are likely even higher than the taxes assessed by most other states. Combined with the state sales tax the highest sales tax rate in Tennessee is 975 in the cities. The following is a guide of sales tax deduction rates per State using the Tax Information publication issued on December 31 2019 to be used in 2020.

Montana State Taxes Tax Types In Montana Income Property Corporate

Who Pays Taxes In America In 2019 Itep

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

How Do State And Local Sales Taxes Work Tax Policy Center

Taxes Fees Montana Department Of Revenue

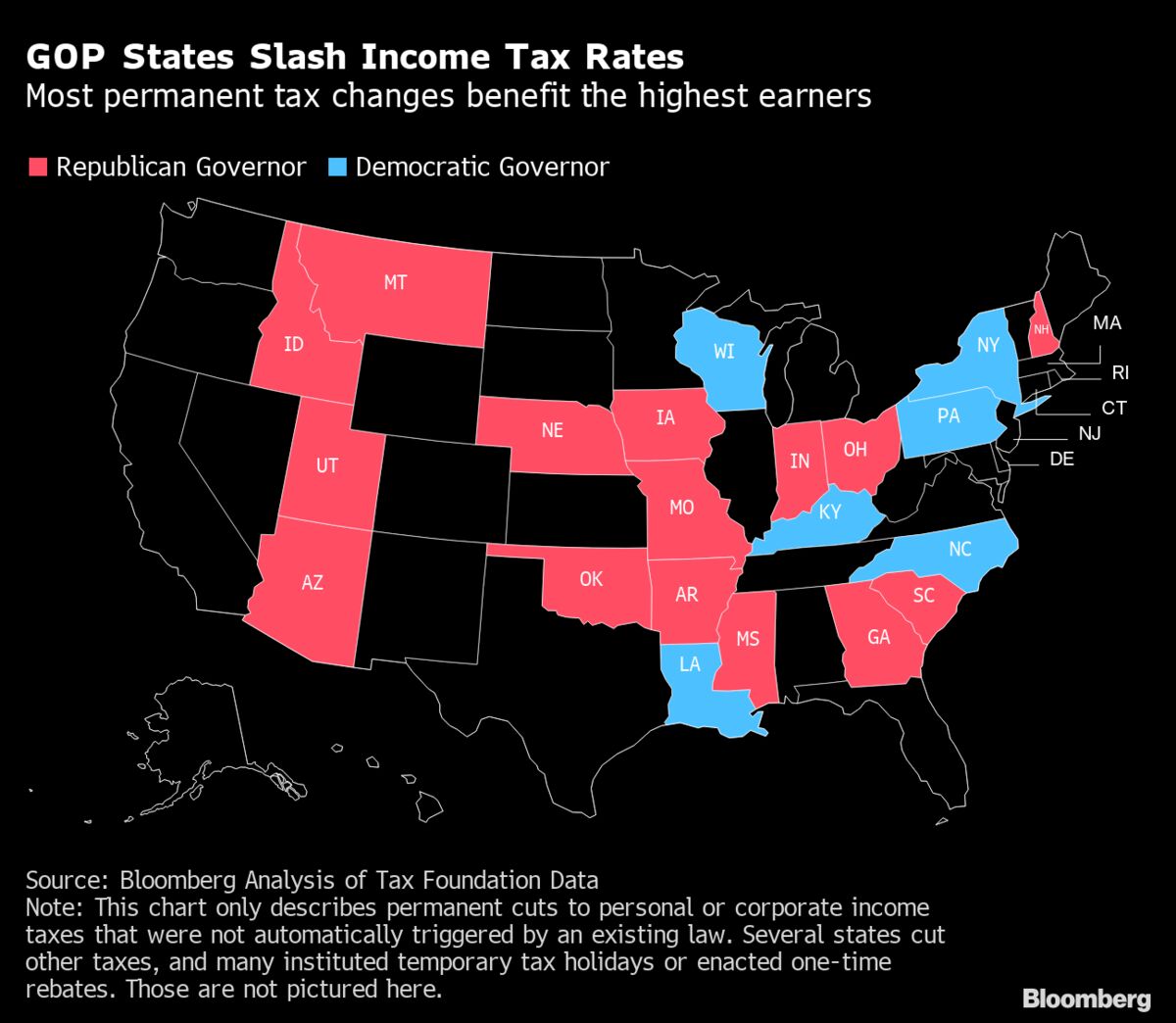

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Who Pays Taxes In America In 2019 Itep

Sales Tax Definition What Is A Sales Tax Tax Edu

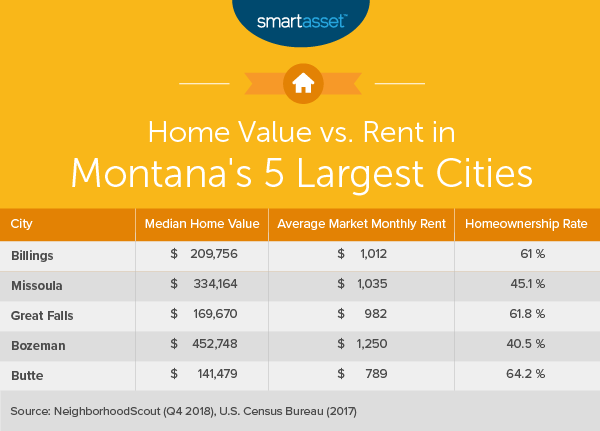

The Cost Of Living In Montana Smartasset

State And Local Tax Collections State And Local Tax Revenue By State

How Do State And Local Sales Taxes Work Tax Policy Center

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Montana State Taxes Tax Types In Montana Income Property Corporate